franchise tax board phone number for llc

If you do not send the required supporting documentation within 30 days of the date on your notice we may deny all or some. Issued by the Comptrollers office 11 digits no dashes Comptrollers File Number.

Irs Form 540 California Resident Income Tax Return

Office locations appointments Visit an FTB field office near you.

. Contact number of franchise tax board sacramento ca the contact number of franchise tax board. The taxpayers can contact the California Franchise Tax Board through the mailbox or through the telephone number. An LLC must have the same classification for both California and federal tax purposes.

1 If you simply need to ask someone questions about your business dial this number. An XT Number is for franchise tax. Our mission is to help taxpayers file tax returns timely accurately and pay the correct amount to fund services important to Californians.

Your LLC owesowed an 800 payment for the 2020 tax year due Sept. Follow the links to popular topics online services. Contacted the practitioner line of the FTB at 916-845-7057 and obtained information regarding these notices.

What are the FTB address and contact number. California Franchise Tax Board. Mailing addresses List of FTB mailing addresses.

Employment Development Department 3321 Power Inn Road Second Floor Sacramento CA 95826. The california franchise tax board may review the information that you provide and may refer any claim forms that it believes were submitted with false or fraudulent information to appropriate. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code.

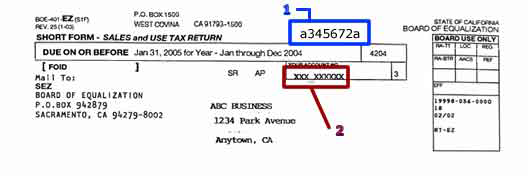

Company just now california franchise tax board contact phone number is. Here is how to contact an actual operator at CA Franchise Tax Board. Not Taxpayer Number 10 digits numbers only Texas Secretary of States Filing.

All LLCs will be given an XT Number at the end of the Questionnaire since all LLCs are responsible for filing Franchise Tax Reports. File a return make a payment or check your refund. California Corporation ID Number 7 digits Limited Liability Company LLC.

800-852-5711 916-845-6500 and Address is 300 S Spring Street Suite 5704 Los Angeles CA 90013-1265 USA The California. You can call the Franchise Tax Board 800-852-5711 800am 500pm M-F and ask though. Register using these numbers.

Joint Agency Office EDD Board of Equalization and Franchise Tax Board. Secretary of State SOS ID Number 9 or 12 digits Partnership. California Franchise Tax Board Contact Phone Number is.

To register or organize an LLC in California contact the Secretary of State SOS. Phone fax List of phone numbers of FTB representatives. Log in to your MyFTB account.

While 916-845-4300 is California Franchise Tax Boards best toll-free number there are 7 total ways to get in touch with them. Franchise Tax Board PO Box 1468 Sacramento CA 95812-1468. 8 AM to 5 PM PT general and MyFTB 8 AM to 5 PM PT levy lien wage garnishment installment agreement or revive dissolve or suspended business Closed on.

The next best way to talk to their customer support. They will notify you that you should be filing form 568 with the state of.

2021 Form 540 2ez Personal Income Tax Booklet California Forms Instructions Ftb Ca Gov

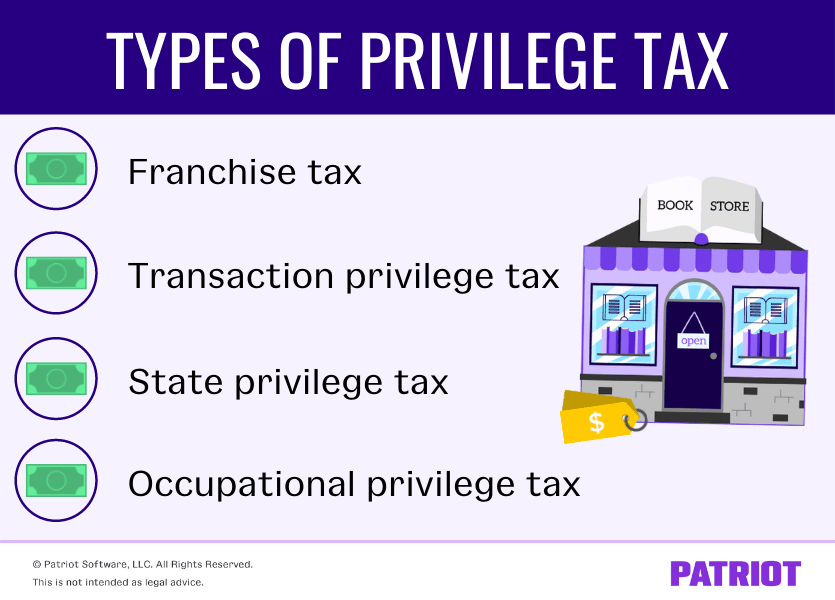

What Is Privilege Tax Types Rates Due Dates More

Annual Report And Tax Instructions Division Of Corporations State Of Delaware

What Is Franchise Tax Overview Who Pays It More

Franchise Tax Board Ca Ftbfiling Sc Twitter

![]()

Llc California How To Start An Llc In California Truic

Franchise Tax Board Ca Ftbfiling Sc Twitter

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Where S My Refund California H R Block

State Corporate Income Tax Rates And Brackets Tax Foundation